For example, the first payment will be payment number 1, the second payment will be payment number 2, and so on. The payment number is simply the number of the payment. For each subsequent payment, you will add one month to the previous payment date.

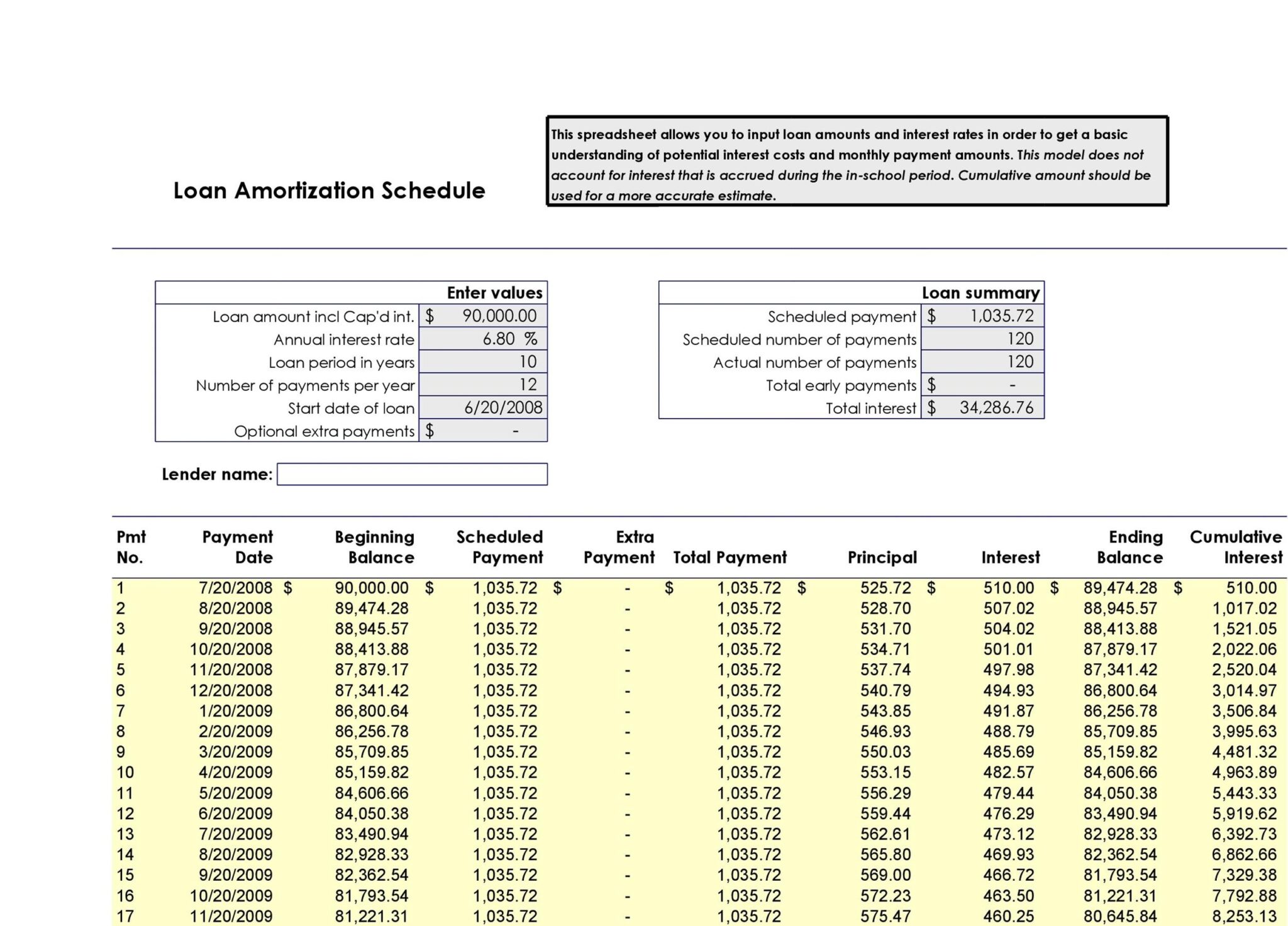

The payment date for the first payment is the start date of the loan. To calculate the principal payment, you will subtract the interest payment from the total payment amount. To calculate the interest payment for each payment, you will multiply the beginning balance by the monthly interest rate. Step 5: Calculate the Interest and Principal Payments To calculate the ending balance for each payment, you will subtract the principal payment from the beginning balance. For the second payment, the beginning balance will be the ending balance from the first payment. The beginning balance for the first payment is simply the loan amount. This will give you the monthly payment amount, which you can round to the nearest cent. For example, if you have a loan amount of $10,000, an interest rate of 5%, and a loan term of 5 years (60 months), the formula would be: The PMT function requires three arguments: the interest rate, the number of payments, and the loan amount. You can use the PMT function in Excel to do this. The next step is to calculate the payment amount. In the first row of the worksheet, create headers for the following columns: Payment Number, Payment Date, Beginning Balance, Payment, Interest, Principal, and Ending Balance. Start by opening a new workbook and creating a new worksheet. Once you have all the necessary information, it's time to set up your Excel spreadsheet. You will also need to know the start date of your loan and the first payment date. This includes the loan amount, interest rate, loan term, and payment frequency. The first step in creating an amortization schedule in Excel is to gather all the necessary information about your loan. Creating an amortization schedule in Excel is a simple and effective way to keep track of your loan payments and ensure that you stay on track with your debt repayment plan. An amortization schedule is a table that shows the breakdown of each payment, including the amount that goes towards the principal and the interest. Amortization is the process of paying off a debt over time through regular payments.

0 kommentar(er)

0 kommentar(er)